property tax bill las vegas nevada

Enjoy the pride of homeownership for less than it costs to rent before its too late. 500 S Grand Central Pkwy 1st Floor.

Understanding Your Residential Bill

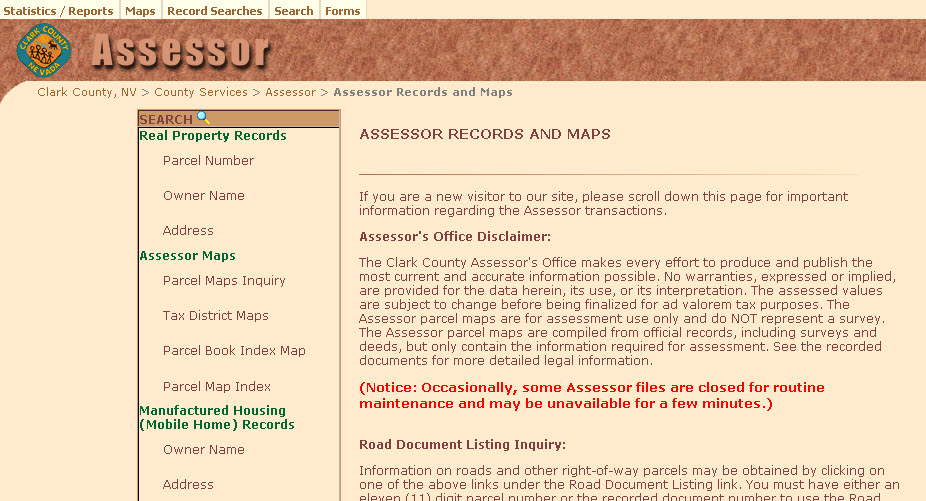

You must have either an 11-digit parcel number or the recorded document number to use the Road Document Listing transaction.

. A previous version of this article incorrectly stated. Las Vegas NV 89106. Census Bureau compiled by WalletHub.

Property tax is a tax on property that the owner of the property is required to pay. Doing Business with Clark County. Thus if your tax rate is 325 and your assessed value is.

They must be paid on time in order to avoid penalties. 06765 21371. WHAT THE TREASURER DOES.

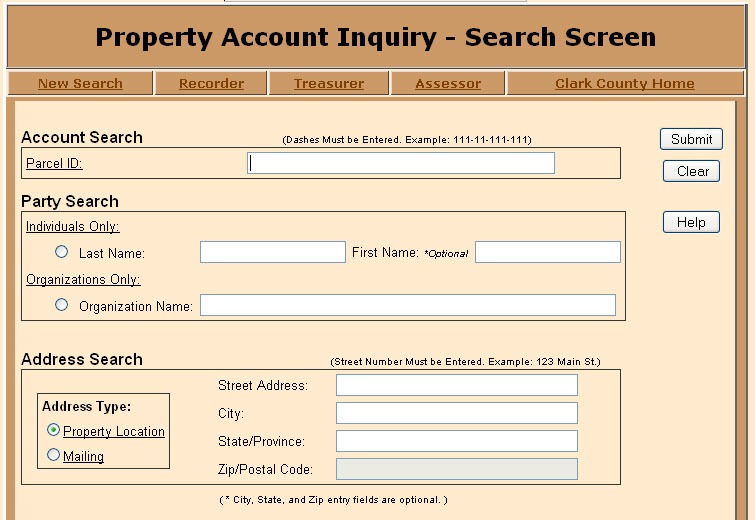

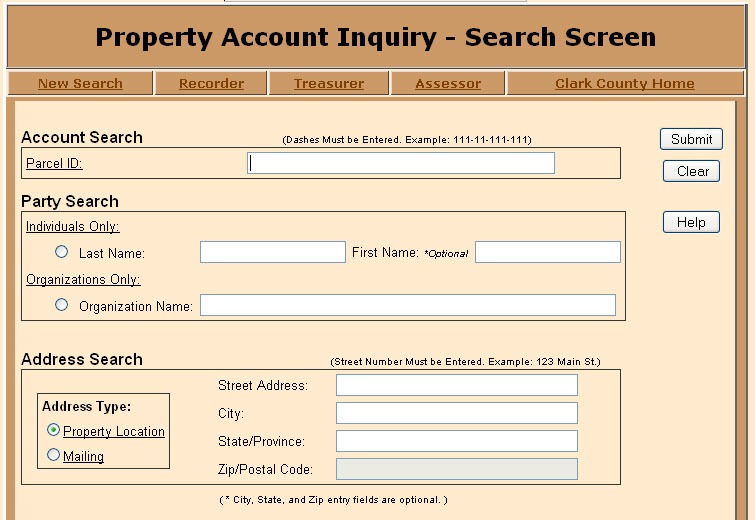

Judging the Judges 2019. 123 Main St City State and Zip entry fields are optional. The Tax Lien Sale.

Las Vegas City Fire Safety. Las Vegas NV 89155-1220. Upon payment of all taxes and costs the county will reconvey the real property back to the owner.

00942 2976. Free Things To Do in Las Vegas. The Assessor is required by Nevada law to discover list and value all property within the county.

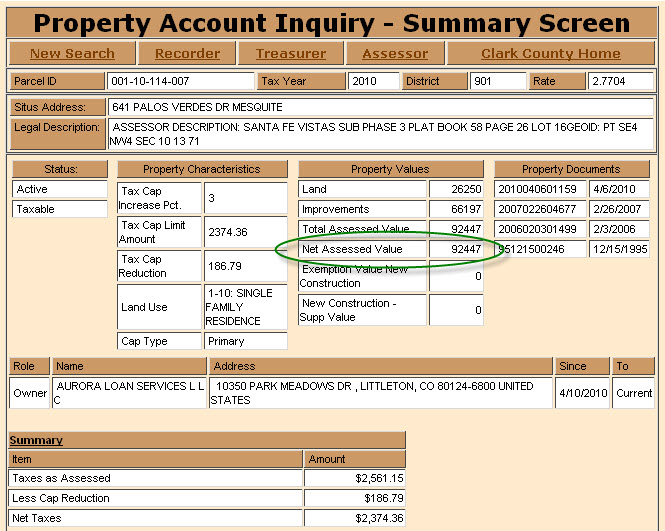

The assessed value is equal to 35 of the taxable value. Thus even if home values increase by 10 property taxes will increase by no more than 3. Since they are voter-approved they are not subject to the same limits.

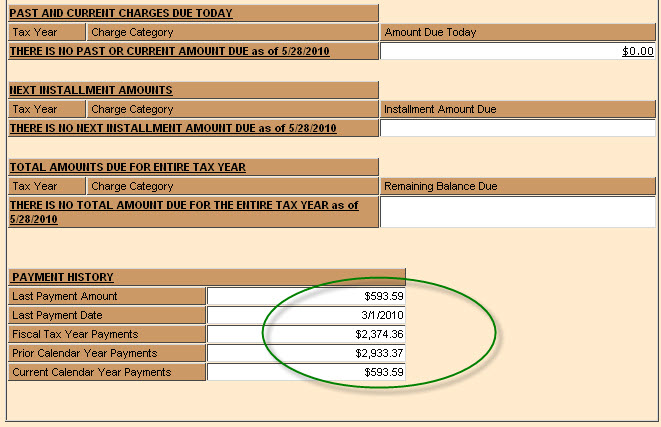

Learn all about Las Vegas real estate tax. Checks for real property tax payments should be made payable to Clark County Treasurer. Property Account Inquiry - Search Screen.

111-11-111-111 Address Search Street Number Must be Entered. Tax rates in Nevada are expressed in dollars per 100 in assessed value. Information on roads and other right-of-way parcels may be obtained by one of the links under the Road Document Listing.

02800 8845. If this is your primary residence and your tax cap is not 3 please call the Assessors Office at 702 455-3882. Our main office is located at 500 S.

Supplemental tax bills are separate from and in addition to the annual secured property tax bill. LAS VEGAS Nevadas two-step property-tax assessment and billing system gives unsuspecting property owners no chance to contest their tax bills unless they carefully monitor assessment notices that county assessors must mail to them by Dec. The Assessor values all property subject to taxation.

Instead more than half a billion of that 549 million was abated according to Applied Analysis a fiscal consulting firm hired by the Legislative Counsel Bureau in 2019. The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300. Failure to receive a tax bill does not relieve the responsibility for timely payment nor constitute cause for cancellation of penalty andor cost charges if the tax bill becomes delinquent.

00100 316. Without caps Nevada counties would have collected about 31 billion in property tax in FY 2016. Property tax revenue in the same period has not kept pace.

Property Tax Rates for Nevada Local Governments Redbook. Harry Reid 1939-2021. No later than 500 pm.

These bonds and levies make up 25 to 35 of a typical combined levy rate and tax bill. And Marisol Parker 4831 Torrey Pines Drive Unit. Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be 35000.

00050 158. If you did not receive a tax bill you can request a bill by calling our office at 702 455-4323 and selecting option 3 from the main menu. Road Document Listing Inquiry.

Account Search Dashes Must be Entered. Nevada Property Tax Rates. Nevadas property tax rate is constitutionally limited to five percent of assessed value not market value.

Simply just multiply the property tax rate by the your assessed value 032782 district tax rate x 87500 your assessed value 2868425. IF I PAY TAXES THROUGH AN IMPOUND ACCOUNT WILL MY SUPPLEMENTAL TAX BILL BE SENT TO MY LENDER. Supplemental tax bills are only mailed to the property owner of record.

Tax rates apply to that amount. 15 to determine whether they want to contest the taxable value of. Lets assume you have a business with the following equipment in the City of Las Vegas with a tax rate of 350 per hundred dollars of assessed value.

These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more. Clark County has one of the highest median property taxes in the United States and is ranked 546th of the 3143 counties in order of. Grand Central Pkwy Las Vegas NV 89155.

Find My Commission District. Property owners only have until Jan. If you are contemplating becoming a resident or just planning to invest in the citys property youll come to understand whether the citys property tax statutes are favorable.

Make Real Property Tax Payments. There are currently 3395 red-hot tax lien listings in Las Vegas NV. Facebook Twitter Instagram Youtube NextDoor.

Your property taxes would be calculated at 286843 per annum. In addition Nevadas tax abatement law protects homeowners from sudden spikes in their property taxes. Hawaii has the lowest rate 27 percent and.

00950 3001. The tax is levied by the governing authority of the jurisdiction in which the property is located. Yearly median tax in Clark County.

Nevadas effective property tax rate calculated as a percentage of home value is among the lowest in the nation at about 70 percent according to data from the US. NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Please verify your tax cap.

You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook. If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax payments call our office to request a bill at 702-455-4323 option 3. To ensure timely and accurate posting please write your parcel number s on the check and include your payment coupon s.

You can also obtain the Road Document Listing in either of the. If you have. When May a Business Expect a Personal Property Tax Bill.

With our guide you will learn important information about North Las Vegas property taxes and get a better understanding of what to expect when you have to pay. Apply for a Business License. Make Personal Property Tax Payments.

Clark County collects on average 072 of a propertys assessed fair market value as property tax. Whether you are already a resident or just considering moving to Las Vegas to live or invest in real estate estimate local property tax rates and learn how real estate tax works. In most counties in.

On the third business day before the date scheduled for sale of the property. Grand Central Parkway 2nd Floor Las Vegas Nevada 89155. Treasurer - Real Property Taxes.

LVMPD Manpower Supplement LV. The County Treasurers office bills and collects taxes on all real property in Clark County. The property is assessed at 35 of its current appraised value.

Taxpayer Information Henderson Nv

Mesquitegroup Com Nevada Property Tax

Lvcva Spends Millions To Wine And Dine But Some Question Spending Las Vegas Review Journal

Cortez Masto Introduces Clark County Lands Bill To Expand Las Vegas Footprint Designate Public Land For Conservation The Nevada Independent

Mesquitegroup Com Nevada Property Tax

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Mesquitegroup Com Nevada Property Tax

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

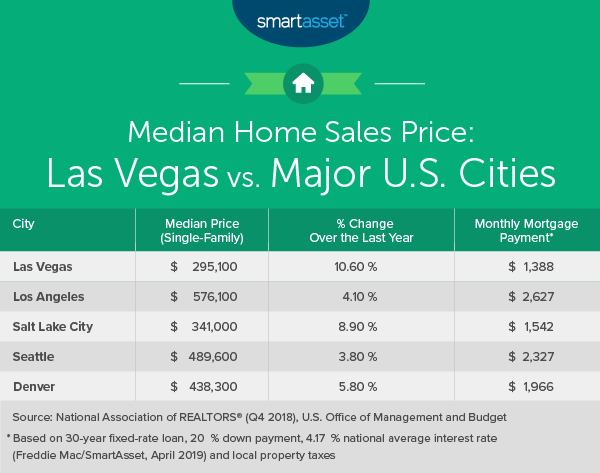

The Cost Of Living In Las Vegas Smartasset

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Mesquitegroup Com Nevada Property Tax

Las Vegas Area Clark County Nevada Property Tax Information

Taxpayer Information Henderson Nv

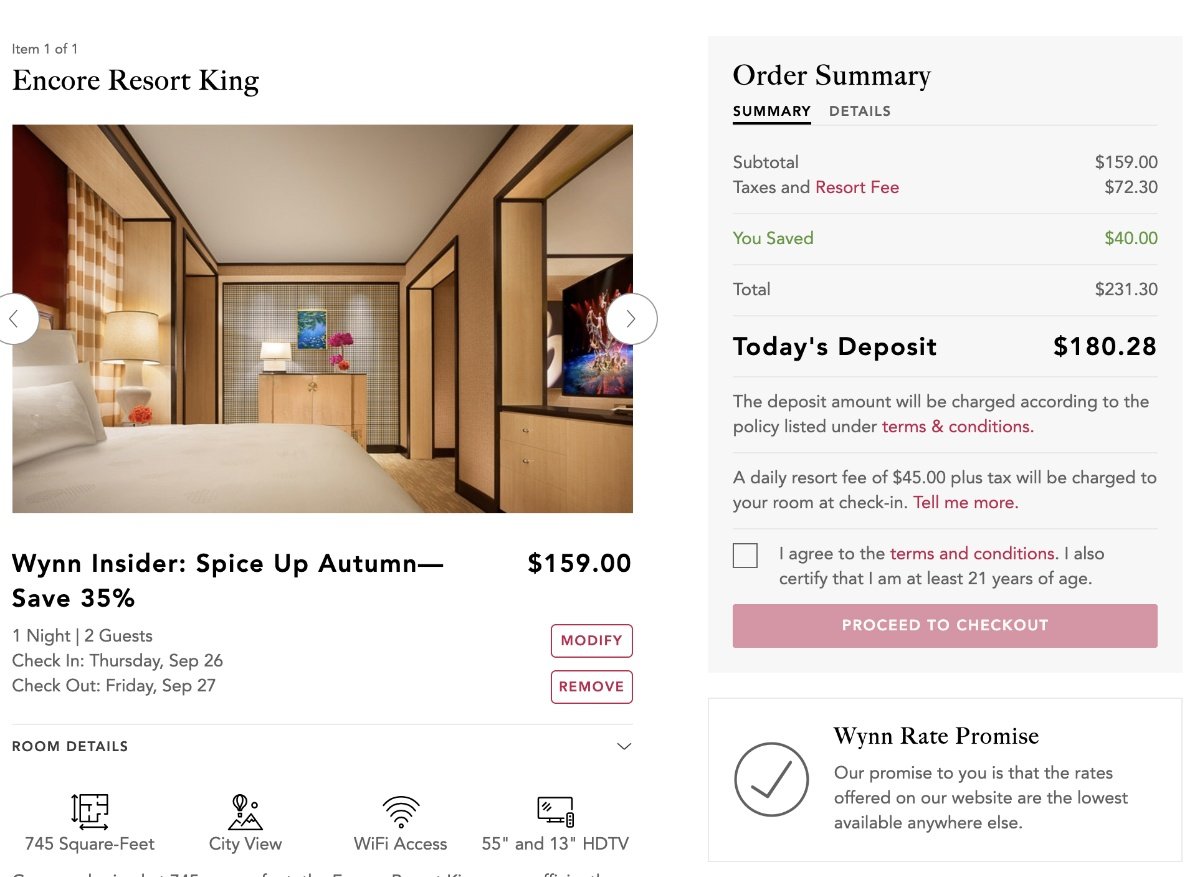

Las Vegas Resort Fees Bill Would Require Rates To Include Fees